Hello, the annual detailed expense report is now available!

We’ve been publishing our expenses since we started this blog, so this is the third annual report detailing how we spent our money. For the last five years, one of our New Year’s Day traditions has been to drink coffee while reviewing our previous year’s expenses in order to create a budget for the coming year.

It comes as no surprise that we keep track of our expenses. After all, if we are to run our home like a business, we must keep track of our expenses.

Last year’s spending was roughly in line with previous years, and we expect it to remain so until early retirement. The categories will change, but our living expenses are unlikely to change significantly.

We suffered a significant loss last year

We had another great year financially, but it was a rollercoaster ride emotionally. My mother died in 2016, and nothing will ever be the same without her. We will always cherish the wonderful memories we have of her.

Since our motto is to never take our loved ones for granted, we have no regrets because we spent as much time as we could with her. Our loss also served as a reminder of why we are pursuing FI—to have more time to spend with our loved ones.

We’ll miss you, mom.

How we classify our expenses

Speaking of life and death, we try to be mindful of how we spend our money because it represents the life energy we sacrificed to earn it. We can spend less on things that don’t add value to our lives and more on things and experiences that enrich our lives and bring us true happiness by lowering the cost of housing, dining, and transportation.

If you’re new to the blog, our expenses are classified as essential, discretionary, and gifts/donations.

Essential Expenses

Category | 2016 | 2015 | Comments |

| Net Rent | $2,358 | $2,798 | $13,800 (gross rent) – $11,442 (profit from rental property). |

| Internet | $348 | $520 | We pay $29 a month for high speed internet. |

| Electricity | $717 | $634 | That’s electrifying! |

| Trash | $112 | $206 | We switched to a la carte trash collection. It costs $4 for a 32-gallon trash can and there is no charge for recycling! 🙂 |

| Groceries | $5,346 | $5,205 | Higher grocery bills as a result of purchasing more organic produce in order to avoid GMOs. Stop poisoning our food! |

| Home Supplies | $915 | $781 | |

| Mobile Phones | $840 | $840 | Cricket plan of $35 a month per phone. |

| International Calls | $30 | N/A | Long distances charges to call relatives abroad. |

| Auto Insurance | $647 | $1,039 | Insurance is for one car now. Yay! |

| Fuel | $975 | $844 | Oh crap, oil is going up. Stop cutting production! |

| Auto Services, Parts, Registration, Other | 1,150 | $304 | Car repairs included the replacement of an alternator. I miss my mechanic brother-in-law. |

Total | $13,438 | $13,171 |

We spent $13,438 on necessities. These are essential expenses that we cannot usually avoid.

Net Rent

What that heck is net rent?

We cheated on this one. We apply our rental property income to this line, which is why it is so low. Our monthly rent is $1,150. We decided a few years ago not to buy a house and instead invest the money in a rental property. We feel better knowing that someone else “pays” our rent, so we consider the rental property revenue to be a wash.

This gives us a psychological boost because we don’t feel like we’re wasting money by renting, and it also allows us to see how much we spend on housing after making this decision. We properly report it as income on our tax returns.

Discretionary Expenses

Category | 2016 | 2015 | Comments |

| Health Insurance | $1,144 | $1,066 | Our employer provides Aetna insurance. |

| Dental Insurance | $208 | $312 | |

| Vision Insurance | $164 | N/A | José gets it biannually. |

| Renter’s/Umbrella Insurance | $288 | $196 | We reinstated renter’s insurance because our umbrella policy requires it. |

| Toll Fees | $296 | $275 | |

| Parking | $63 | $49 | |

| Public Transportation | $168 | $157 | |

| Dry Cleaners | $60 | $69 | |

| Shipping/Office supplies | $6 | $37 | |

| Alcohol & Bars | $1,726 | $1,547 | Hmmm… Is it time to call the hotline? |

| Coffee Shops | $88 | $117 | Limited people-watching available for Tatiana in the suburbs? |

| Restaurants | $3,806 | $2,920 | |

| Lunch at Work | $231 | $530 | We brought more lunch to work than the previous year. |

| Entertainment | $798 | $914 | Fewer concerts attended. 🙁 We need a Latin concert so bad this year. There’s a promising lineup coming up! |

| Education | $0 | $0 | Investing in yourself doesn’t need to cost money. |

| Fees, Interest & Bank Charges | $0 | $0 | Not a typo. |

| Health & Fitness | $710 | $935 | We use the gym at work. |

| Home Furnishings | $0 | $852 | |

| Personal Care | $778 | $689 | |

| Pets | $101 | $447 | Budget for my wife’s cat. |

| Clothing | $1,809 | $836 | We were in desperate need of some new clothes. |

| Electronics & Software | $1,535 | $308 | It’s upsetting to see technology become obsolete! |

| Sporting Goods | $1,114 | $11 | We’ll be fit now because we got the gear! Right? |

| Shopping (other) | $253 | $373 | Oh look, we spent less than $300 on shopping this year. Not bad at all. 😉 Now that’s a Mustachian kind of spending. |

| Travel | $5,734 | $6,269 | |

| Miscellaneous | $305 | N/A | |

| Auto Sale | -$1,497 | N/A | One of our goals was to sell our second vehicle last year. Tatiana sold it within 24 hours of posting on Craigslist. Mission accomplished! |

Total | $19,888 | $18,909 |

We spent $19,888 on discretionary expenses. These are expenses that we can eliminate if necessary.

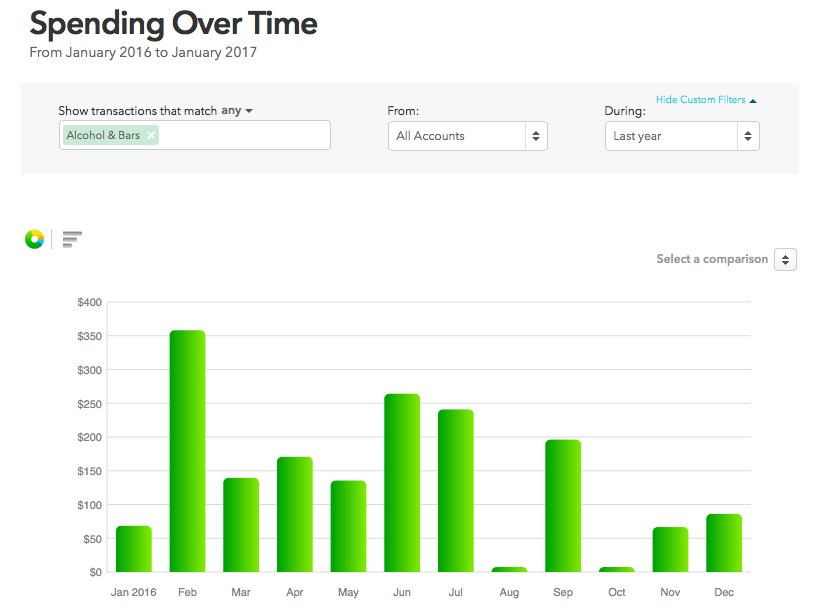

Alcohol & Bars

We intended to spend less on alcohol last year but ended up spending more (at least on paper). On paper, this means that in previous years, the cost of drinking at an all-inclusive resort was buried under the cost of hotel travel. We didn’t go to an all-inclusive last year, so we had to pay for alcohol separately.

We also split any alcohol purchases from restaurants as well as our grocery bills. That way, we can see exactly how much we’re spending on alcohol.

We had a big wake-up call in August when we had a month of change and realized we were spending nearly $5 per day on alcohol. Even if we don’t drink every day and spend more money because we buy more expensive mixed drinks, that can’t be healthy.

The good news is that we reduced our alcohol consumption following the month of change, as shown in the graph below.

We spent more money on alcohol in February because we went to Punta Cana and did not stay at an all-inclusive resort.

We have a new challenge!

We’ve decided to go alcohol-free this year after much deliberation in our household, so our goal is to have no alcohol expenses. We’re up for the task. There will be no alcohol in 2017.

Fees, Interest and Bank Charges

The $0 in this column is not an error. There were no interest charges in this case. There are no car payments, credit card interest payments, or anything else that requires us to pay interest to a company. Those days are over, at least for Tatiana, who never had debt.

We are debt-free and intend to remain so.

Shopping

Last year, we spent an unusually large sum on shopping. I wanted to break it down so that we can keep track of it in the future. We needed to replenish a lot of clothing in the clothing department because we hadn’t done much shopping in previous years.

In terms of technology, we replaced my laptop as well as Tatiana’s smartphone 4.

Another significant expense was hiking equipment for the Colorado trip, which included boots and sneakers.

Travel

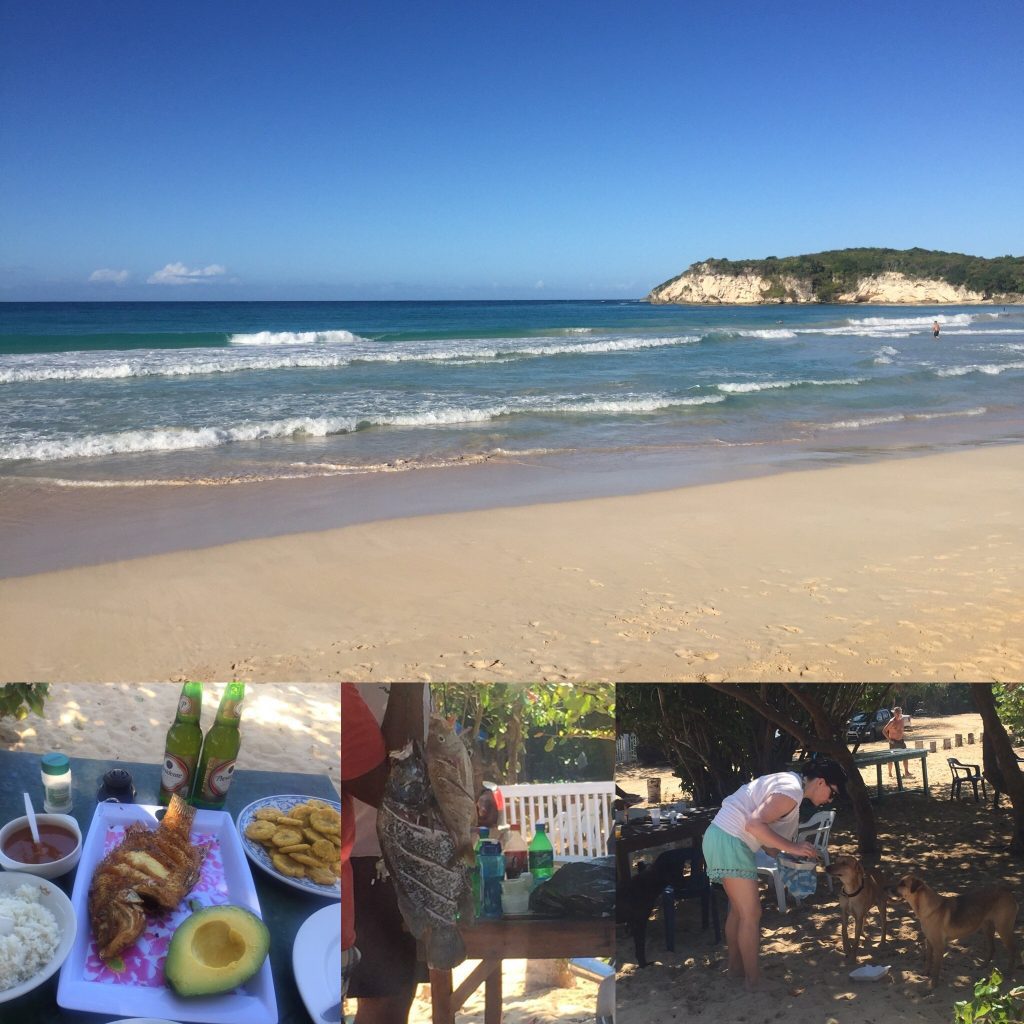

We were able to take a few trips last year.

- In February, we went on a 15-day vacation to Punta Cana. It was a fantastic experience exploring Punta Cana without staying at a resort. We wholeheartedly recommend it!

2. Tatiana returned to her homeland of Belarus/Lithuania in July after an 18-year absence. She had a long layover in Finland, so she and her mother took advantage of the opportunity to explore downtown Helsinki. It was a nice 19-day vacation.

3. While she was away, I drove to Providence, RI to spend time with my father and family.

4. In September, we flew to Colorado for a 12-day trip.

5. Finally, in November, we took a flight to Tampa, Florida. Then we drove to Gainesville and North Port for a total of 12 days to see the family.

Overall, we had a great time at our destinations, and exploring Colorado’s hikes was a lot of fun.

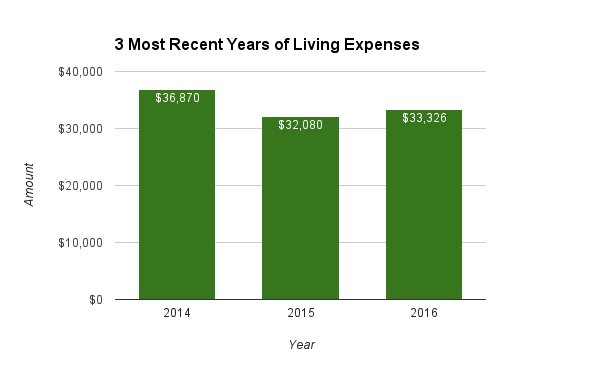

Back to our expenses, In 2016, our living expenses totaled $33,326 when essential and discretionary expenses were combined.

Our living expenses and the Freedom Fund

This is the amount we hope to fund with our Freedom Fund when we retire—an annual budget of $30,000 to $35,000, adjusted annually for inflation. We anticipate that some of our expenses will be lower in early retirement.

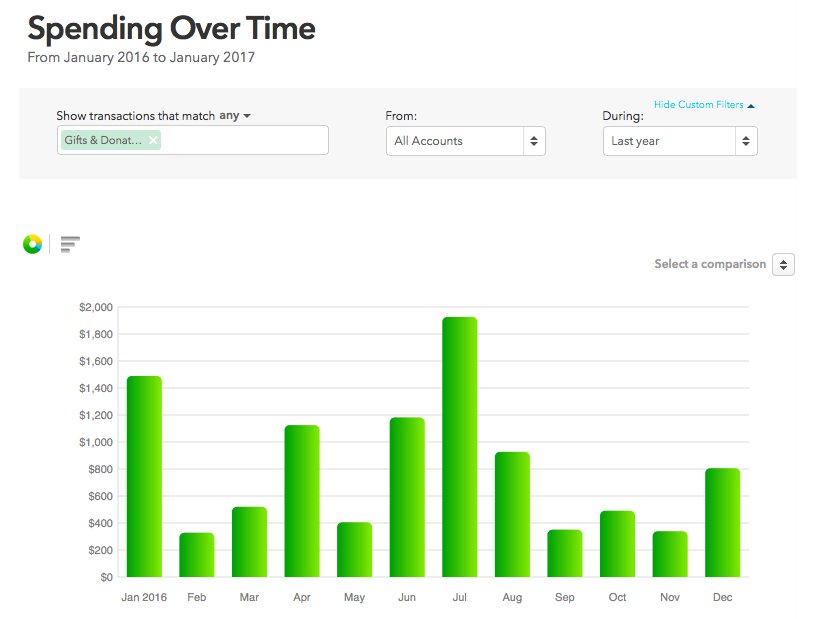

Gifts and Donations

Category | 2016 | 2015 | Comments |

Gifts & Donations | $10,933 | $8,802 | The total includes $1,040 in charitable work contributions deducted from paychecks, which are not accounted for in the chart below. |

A large portion of this money is used to help our parents. The remainder is used for charitable contributions and a few thoughtful gifts for friends and family.

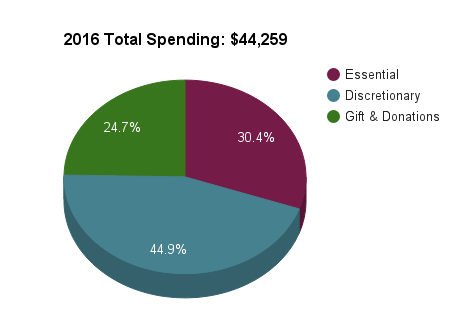

We spent a little more than usual this year because we attended a few beautiful weddings and Tatiana’s gifts to friends and family in Belarus/Lithuania. This bucket received $10,933, or 25% of our total expenses.

We convinced everyone two Christmases ago to forego excessive gift exchanges for birthdays and holidays in favor of spending time with our loved ones. So, no, we didn’t just go overboard on Christmas gifts, and here’s the chart to prove it. 🙂

How we spent our money

So there you have it. Our spending money was divided as follows: 30% for necessities, 45% for “fun stuff,” and 25% for charitable contributions.

Our expenses are not expected to increase this year. It’ll be interesting to see how our expenses change once we retire. That retirement date has yet to be determined, but it is not far away. We can already smell it!

I’m impressed with your decision to cut out alcohol, especially since it was trending the opposite direction. Will be interested to hear if you are able to do it!

Hi PFK-

Yes, it feels kind of crazy to make such a commitment, but I’m up for the challenge and I’ll definitely report on it. Now I’m not saying it will be easy but we’ve been successful so far. I haven’t drank since mid December and the alcohol expenses are at $0 for the year. Now what to do with the newfound money? Keep investing! 🙂 Thanks for stopping by.